The return of volatility: normalisation story or recession risk?

Key messages

- This cycle is unusual and we are rapidly transitioning from acceleration to normalisation, and with signs of a rising risk that we could enter a cyclical slowdown sooner than expected.

- The current volatility regime reflects a monetary normalisation and probably the temporary disappearance of the implicit “FED put”.

- Market stress reflects a fear that the FED will conduct normalisation steadily, almost mechanically, bringing back in mind the worst times of 2018 when the FED hiked while the economy was already slowing down.

- The words used by J. Powell to highlight that the normalisation path will remain pragmatic, data dependent and flexible were not enough to support markets.

Analysis of the market environment: weaker signals

Monday’s violent sell-off on equity markets is not only a short-term geopolitical stress story; it is part of a correction movement explained by a stagflationary narrative starting to coming into play since the beginning of the year.

Indeed the correction was amplified Wednesday mid-afternoon by very weak activity data in the US (US Flash PMI down by 6 points). This led markets to fear that FED confirms a hawkish policy while the economy seems to show signs of weakness.

Nevertheless, we should handle this US macro data with care. Indeed, it has already happened in the past that Flash PMIs have contracted by several points (as in summer 2021) before bouncing back. Besides, we know that these January PMI figures are affected by the Omicron wave, and could return to expansionary levels thereafter.

The challenge for markets is therefore the reading of these weak macro data: a short term drop reflecting Omicron-related restrictions, or a fast-forward into the landing of this cycle.

It is critical that upcoming macro data (job creation, consumer confidence, business confidence) continues to send a constructive picture of the state of the economy. History shows that the short to medium correlation of equity markets with economic surprises and the direction of PMIs is relatively robust.

On the bottom-up side, earnings growth will be positive in 2022, but the peak of the acceleration and positive surprises is behind us. A good earnings season is therefore crucial for a market rebound in February.

So far, the numbers coming from companies are surprising positive, in a year which should deliver 6% to 10% earnings growth in mature markets. However, the attention of investors and analysts remains focused on the qualitative message regarding the outlook for wages, margins and supply chain disruptions.

Market reaction to the FED meeting

On Wednesday -a market day that was rather positive - the initial reaction to the publication of the FOMC press release was positive.

Indeed, the communication of policy sequence was in line with expectations, with a confirmation of i) the end of asset purchases in early March ii) an upcoming first rate hike on the table iii) a balance sheet reduction to come after the rate hike cycle is engaged, but without details on the magnitude, the pace and the technicalities on the quantitative tightening.

However, the press conference of Jerome Powell was received negatively by markets for several reasons:

- The comments regarding the state of the US economy were largely upbeat (with a “very strong labour market”), and which “no longer needs sustained high levels of monetary policy support”. Powell seemed to ignore the signal of weakening macro momentum sent by Monday’s PMI data ; he just mentioned that “The recent sharp rise in COVID cases associated with the Omicron variant will surely weigh on economic growth this quarter”

- In the speech preceding the Q&A there was little if no reference to the volatile market environment affecting the financial conditions nor comments on the geopolitical risks.

- The conference was the opportunity to come back on the analysis of inflation, with a recognition that inflation is more persistent than expected and “has spread to a broader range of goods and services”, while wages are rising faster than expected, at a faster pace than productivity. This is implicitly rising the risk of a loop between wages and prices, even if the FED continues to believe that inflation will decline progressively in 2022.

- The words used to describe the upcoming “steady” rate hike cycle (rather than “gradual”) pushed some observers to conclude that the FED could adopt a mechanical approach. This perception may have been reinforced by the fact that upcoming balance sheet reduction was depicted as “occurring in a predictable manner”, i.e. on a pre-set course, even if the pace, magnitude and technicalities have not been disclosed.

- However, we cannot say that the conference was a fully hawkish one; indeed, Powell retained a cautious approach regarding the economic outlook, qualified as “highly uncertain” and that determining the appropriate monetary policy requires “humility”.

- Even if Powell repeated several times that the direction and pace of the balance sheet reduction and rate hikes will be flexible, data dependent, the markets decided to retain mostly a hawkish perception of a meeting which remained relatively balanced. This is also probably explained by the fact that the risks on the macroeconomic outlook quoted by Powell referred mostly to the risk of having a more persistently high inflation rate.

- This means that the FED will probably have to come back towards investors in the upcoming communication opportunities to insist more on the pragmatic, flexible and data dependent approach.

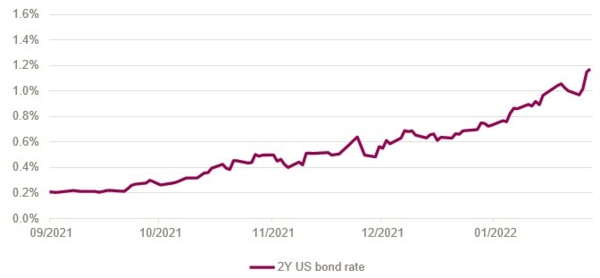

Chart 1: Sharp upward reaction on short rates after Jerome Powell's speech

Source: Bloomberg, Indosuez Wealth Management

A new framework for volatility and valuation emerging

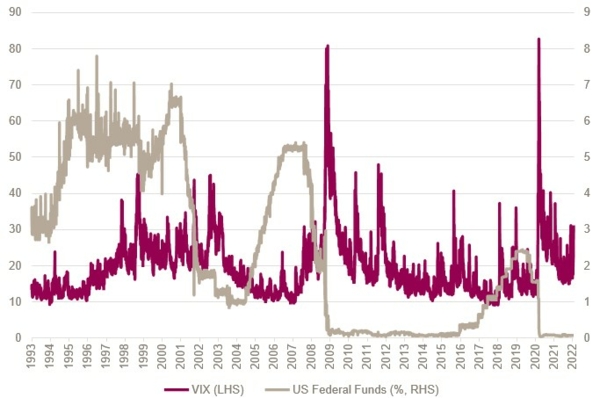

In this uncertain macro, monetary and geopolitical context, the volatility regime should normalise after Monday’s peak, but stabilize at higher levels in 2022. This is not mechanically due to the rise of Fed fund rates, as the past shows that rate increases in 2004-2007 does not come with higher volatility, but rather the contrary (see chart 2). The appropriate comparison remains probably the “taper tantrum” of 2013 and the hawkish and mechanical rate cycle of 2018.

Chart 2: Implied volatility on US equity stock markets versus Fed Funds

Source: Bloomberg, Indosuez Wealth Management

In many market compartments, and as backed by modern portfolio theory, a higher volatility regime generally deserves a lower equilibrium price for risk assets, while higher bond yields imply lower valuation metrics for equities, that are mechanically discounted at higher rates, all other things being equal. The latter is particularly true for expensive quality growth stocks, characterized by very long implicit duration and valuations that are mathematically, significantly more sensitive to long-term rates than the broader equity market (notably when compared to cyclical stocks).

In this context, one big question mark for investors is whether they should (or not) start to chase market opportunities in this environment, notably after the correction witnessed on quality and growth stocks, where fundamentals remain sound. On this point, we think that the recent correction could start to offer entry points for investors, provided that they keep a good balance between value and growth stocks, with a strong focus on fundamentals and notably cash flow returns, while avoiding richly valued stocks which are still vulnerable.

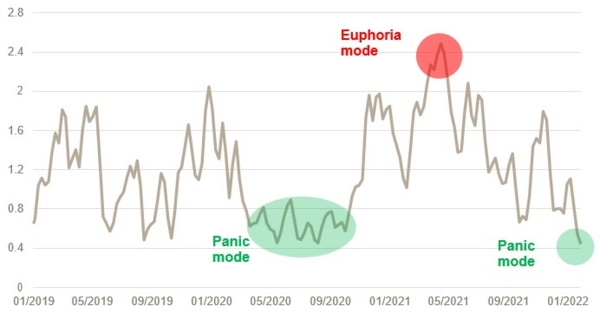

Chart 3: Bull/Bear Index at its lowest level since COVID crash in March 2020

Source: Bloomberg, Indosuez Wealth Management

What to focus on

In conclusion, it is highly important that investors take a step back from market daily movements to focus on medium-term drivers affecting the direction of markets: i) the macroeconomic trend ii) the earnings cycle iii) the monetary environment.

If 2 of these 3 dimensions are less supportive and start to revert simultaneously, there will be little support for markets in the short run, until we reach an oversold situation from a technical and valuation standpoint, but there will be the need for a macro/micro/monetary catalyst to generate a rebound.

In the end, it is a matter of time horizon and leverage. There are no risk-free assets in a normalisation world beyond cash, which has a largely negative yield net of inflation. The current market probably requires more stomach to cope with rising volatility, but offers opportunities to those investors capable of keeping a long-term approach to their investments beyond the rising uncertainties which by definition will never totally disappear.

Edited as per 28/01/2022

January 31, 2022