Zero interest rate policy until 2023: take-aways from the FOMC

Yesterday, the Fed Chairman delivered long-term guidance on keeping rates at current levels whilst upgrading GDP growth inflation and job creation forecasts. What should we remember from this meeting? Has something changed at the Fed and how can we rationalise the market’s reaction?

1- An upgrade in economic forecasts

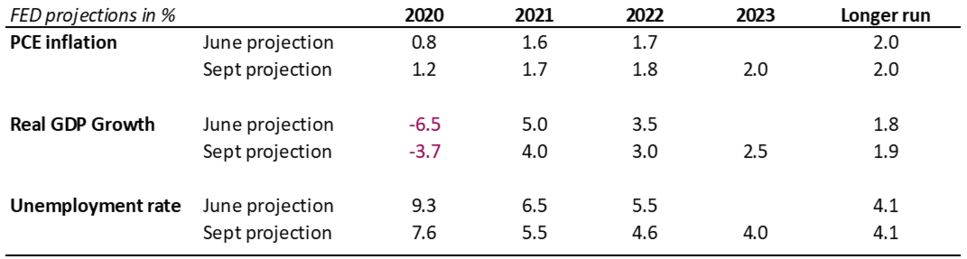

The underlying message from the forecasts revision is an improvement of the recovery in the second half of 2020, both on the GDP and unemployment front, with lower deflationary pressures than initially expected in June. This explains why from a better 2020 base, the growth pace in 2021 is slightly lower than before, but overall the growth trajectory in 2020-2022 is better than expected in June.

We can observe two things from these forecasts:

- Until 2023, the unemployment rate remains below the targeted level which justifies a prolonged accommodative stance;

- Inflation data remains below the medium term target of 2% until 2023, but the Fed is confident that in that year (which corresponds more to a medium term horizon than a precise forecast), the economic recovery will revive inflation towards the medium term target.

These full-year figures focused on PCE inflation obviously do not indicate whether monthly data may reveal some overshooting of inflation due to short-term base effects, that the Fed seems ready to relativise.

2- A prolonged forward guidance, but no additional stimulus

Indeed, Jerome Powell already paved the way at the Jackson Hole symposium for adapting the inflation targeting strategy of the Fed. Further clarification was brought on this topic yesterday; not only the FOMC can accept temporary spikes in inflation above the 2% target, but “the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time”. The aim of the Fed is clearly to anchor inflation expectations at 2%, and the Fed will leave interest rates unchanged until the labour market reaches maximum employment and until inflation is “on track to moderately exceed 2 percent for some time”.

3- A dovish stance on risks surrounding the recovery, praising for more fiscal action

Beyond this policy direction and forward guidance, the language adopted by Jerome Powell regarding the risks surrounding the economic recovery and notably the pandemic, as well and the stance of fiscal policy, remain cautious. However, the comments on the virus are unchanged since the previous FOMC meeting (“the ongoing health crisis poses considerable risks to the economic outlook over the medium term”). It is rather the comments on the need for additional fiscal stimulus that were perceived negatively.

4- Market reaction interpretation

Overall, the reaction was more noticeable in equity markets than in fixed income and forex markets.

On equities, the growth and momentum styles lost ground, with profit taking on technology against a rotation towards cyclical stocks, such as energy. However, this movement is not backed by a strong change in the rate curve (moderate steepening of 3 bps, partly reversed this morning). On currencies, USD bears may have expected more action and may have been disappointed, leading to a modest appreciation of the green back towards 1.175, but coming back towards 1.18 this morning.

There are several ways to explain the negative equity market reaction yesterday:

- Some uncertainties on how far and how long the FOMC could tolerate an overshooting of inflation;

- The absence of additional stimulus despite a dovish tone;

- The comment regarding the need for further fiscal stimulus as mentioned above;

- Some apparent hesitation in Powell’s answers on his confidence in reaching the 2% inflation target.

The absence of additional stimulus should be relativized given that the FOMC has repeated its intention to continue increasing its holdings of Treasuries and MBS “at least at the current pace”.

5- Implications for our investment strategy?

We think that this FOMC meeting is important in terms of reaction function and forward guidance, but does not constitute a game changer in terms of asset allocation. Central banks confirm that the low interest rates are here to stay and that more can be expected in terms of asset purchases if needed.

Uncertainties regarding the Fed’s reaction function logically fuels volatility, since central bank actions are at the source of the equities recovery since March, but the global picture remains accommodative.

This remains a relatively constructive framework for investors, even if we can feel a form of rotation in dominant market factors. If the central banks support is fully priced in, momentum factors could let the floor to macro factors such as growth, explaining a greater focus going forward on the recovery path and surrounding risks. Nervousness surrounding the recovery could continue to generate volatility on markets. Inflation-linked markets are betting on the Fed’s capacity to anchor investors’ expectations, in line with our own investments on this segment.

A greater risk for quality / growth style and for technology shares would be a strong steepening of yield curves, but we do not foresee this happening at this stage. Therefore, we confirm our relative preference for quality stocks and secular growth themes, whilst keeping a moderate exposure to cyclical and value stocks.

September 17, 2020