Why this correction in US equities?

Volatility has made its comeback, and the bears are waking up after their summer hibernation and a month of August that had the best performances since... 1986.

All the Cassandras will agree that this time they saw it coming, but we must also take into account numerous articles over the past few days justifying the upward acceleration in Big Tech, undeniably the big winners of the post-COVID-19 world and whose valuation ratios are more reasonable than in 2000. In short, who to believe and how to explain this correction, at this precise moment, without any particular catalyst?

At first glance, this is essentially a phenomenon linked to a technical correction after an uninterrupted sharp rise in American technology. The pursuit in this trend was starting to seriously lack catalysts, apart from the trend itself. Could it be classic profit taking then? Classic technical indicators like the RSI had reached the highest level since January 2018 after the correction in February. This drop is the largest variation since June. In terms of flows and volumes, available data showed that technology stocks were heavy in portfolios, with a notable overweight in actively managed funds. Thus, a double phenomenon of concentration in indices, which were amplified in the portfolios of asset managers.

Indeed in terms of current events, there was no real news to justify such a market wobble, especially on a day that was very positive in Europe. This week's PMI data and ADP surveys do not provide explanations for this correction. And recently Jerome Powell’s Jackson Hole speech on the new average inflation target implied a continued, very accommodating stance from the Fed. On the political front, nothing new in the polls or in terms of announcements that could justify a sharp correction.

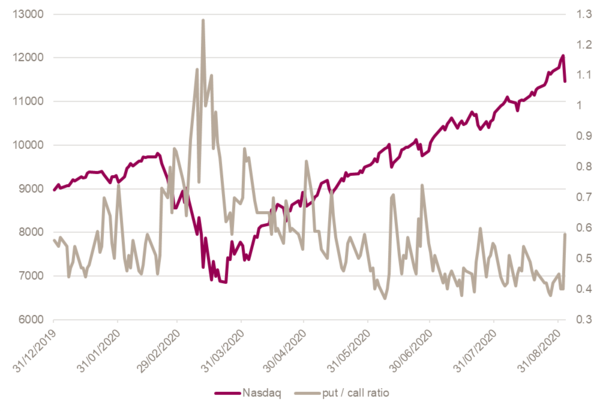

The magnitude of the correction may also be related to market positioning and larger derivative volumes. Before the correction, the level of the put / call ratio (sell options / buy options) had reached a historically low level, pointing to a rather aggressive positioning of the market. Furthermore, it is possible that options markets would have amplified this decline, due to a recent sharp increase in call option volumes on single stocks, concentrated in the technology sector, the unwinding of which may have played a role in accentuating this correction. Finally, the violent increase in volatility of US equities (VIX at 35) has led banks as well as investment funds with capped volatility strategies to cut risks, thereby accentuating the correction.

An option-driven market correction

Source: Bloomberg, Indosuez Wealth Management

If we take a closer look, beyond the technological sector that brought down indices, we see that certain American sectors remain relatively immune to this market reaction such as energy and utilities, and to a lesser extent financials. It is, therefore, the growth style that is affected by this movement, even though the yield curve has tended to flatten in recent sessions, which is usually favourable to quality / growth stocks.

Finally, another interesting factor to look at is the correlation between the dollar and export / technology stocks, which had been quite strong since the summer. It would be difficult to say that the exhaustion and then the beginning of the reversal in euro appreciation is at the origin of this phenomenon, but this factor remains under watch.

So, where can this technical correction lead us? On a technical level, if the downtrend were to continue, the 50-day moving averages and gaps left behind seem to suggest a level at 3’200 on the S&P 500 (and area 10’750/10’900 on the Nasdaq). However, one has to keep in mind that in the past other abrupt, sudden but short “flash crashes” have occurred and generally do not last beyond a few days. This correction phase could, if it were to continue, be reason enough to return to markets. This will also all depend on developments in the American political showdown. In the short term, this justifies a more balanced positioning recently adopted between US and European equities.

September 04, 2020